Get a Credit Freeze to Stop Identity Thieves

Based on an article by BCP & NHFCU Staff – September 10, 2025

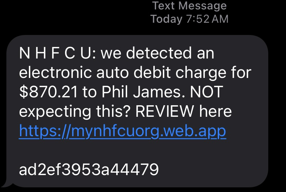

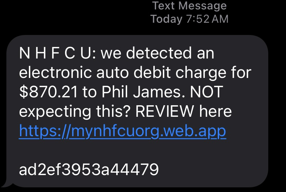

Did someone steal your identity? Or are you looking for ways to help protect yourself from identity theft? A great place to start is freezing your credit. Here’s what to know.

A credit freeze is something you can do anytime, for any reason. But it’s especially helpful if you’re dealing with identity theft or a lost wallet or data breach. While a freeze is in place, nobody can open a new credit account in your name.

A freeze

- is free to place or lift — and doesn’t affect your credit score

- is available to anyone, for any reason

- lasts until you lift it

To place a credit freeze, contact all three credit bureaus — Equifax, Experian, and TransUnion. When you need to lift the freeze — to do things like get a credit card or buy a car — you only need to contact the credit bureau the lender uses to check your credit. When you’re done, you can freeze it again. If you forget that you froze your credit and a lender runs a credit report, they will be notified that the credit is frozen. At that point, you can “thaw” your credit report for the lender to run it and then freeze it again afterward.

Along with a credit freeze, you can also get an initial fraud alert if you are — or suspect you may be — affected by identity theft. Initial fraud alerts (also free) make lenders verify your identity before they grant new credit in your name. There are also two other types of free alerts — extended fraud alerts and active-duty alerts…you choose- the alert depends on your situation and needs. Read Credit Freeze or Fraud Alert: What’s Right for Your Credit Report? to learn more.