Fraud and Security

Your financial well-being is important to us. Visit this page to find news, alerts, and other info to keep you informed about identity theft and fraud scams. Should you suspect, you may be a victim of fraud, please contact us at (603) 224-7731.

How to handle unexpected calls that claim your money is at risk

2/5/2026

Article by: FTC.gov

Your phone rings and what the caller says next sends you into a panic. They claim there’s fraud on your credit card, someone hacked your bank account, you owe a tax debt, or your benefits will end today. Your adrenaline is pumping, and your mind races a hundred miles an hour. They sense this—and they say they can help. Should you trust them? No.

Pump the brakes. The caller might know things about you—like your full name or address—or your accounts. But that doesn’t mean they’re trustworthy. Scammers buy or steal this information to make their lies seem believable.

So, what should you do if you get a call like this?

- Get some basic details, then hang up. What company or bank are they calling from? What’s the problem? Then hang up. Yes, hang up.

- Verify the story by contacting the company or bank yourself. Do you have an account with the company or bank the caller says they represent? Contact the company directly to find out what’s going on:

- Do use the official app or website to get in touch with the fraud department

- Do call the phone number on a recent statement or the back of your card

- Do not rely on top search results to find a company’s contact information—scammers often buy paid search ads so their fake numbers appear at the top of the listings

3. Always talk to a trusted friend or family member. No legitimate fraud department will tell you to keep the call a secret.

And no matter who says they’re calling, never share your personal or account information, don’t grant anyone remote access to your phone or computer, and keep account verification codes to yourself. If you think it’s a scam, report it to the FTC at ReportFraud.ftc.gov. Your report helps stop the scammers.

For more advice, visit How To Avoid Imposter Scams.

FTC warns businesses about fake reviews

1/15/2026

Article by: FTC.gov

Whether you’re hiring a contractor, looking for an apartment, or shopping online, chances are you check out online reviews first. Many people use reviews to see the honest opinions of other buyers — and companies rely on reviews to stand out from the crowd. But some companies write, post, or pay for fake reviews — and that hurts people and honest companies.

To protect consumers, the FTC monitors the marketplace and brings cases against companies using deceptive and unfair business practices. The agency recently sent warning letters to companies urging them to take a look at their reviews and remove any deceptive or misleading statements. The FTC’s letters remind companies that creating, buying, or posting fake reviews, or giving incentives for only positive reviews, may trigger enforcement actions and fines.

Here are some steps to take when you consider reviews:

- Look at a variety of sources and pay attention to whether a website or its reviews are independent or sponsored.

- Check how recent the reviews are and watch for a burst of reviews over a short period of time. That can sometimes mean the reviews are fake.

- Report fake reviews to the website or platform where they appear — like Google, Amazon, or Walmart, among others. Here’s how to report suspicious online reviews across some popular websites.

Be sure to tell the FTC about the fake reviews you spot at ReportFraud.ftc.gov. Follow the reporting path for whatever product or service you were looking at and choose “Other” if you don’t see a path. Just be sure to include “fake review” in the comments field.

Looking to fix your credit?

An illegal credit repair scam isn’t the answer

12/30/2025

Need better credit to do things like get a loan, buy a car, or rent an apartment? There are things you can do, but don’t believe a credit repair company that promises to remove accurate and up-to-date information.

Also avoid companies that tell you to knowingly file a false identity theft report — that’s a crime, and it could result in a fine, imprisonment, or both — and companies that promise to create a “new” credit identity or hide your bad credit history or bankruptcy.

Anything a credit repair company can do, you’ll be able to do for yourself for little or no cost. The best way to improve your credit is to show over time that you pay your debts when they’re due. It’s also a good idea to regularly check your credit report and dispute any errors you find. Learn more about getting your free credit report.

Here’s how to know if you’re dealing with a scammy credit repair company:

- Scammers insist you pay them before they help you.

- Scammers tell you not to contact the credit bureaus directly.

- Scammers tell you to dispute information in your credit report you know is accurate.

- Scammers tell you to lie on your applications for credit or a loan.

- Scammers tell you to file a false identity theft report.

- Scammers don’t explain your legal rights when they tell you what they can do for you.

For more on what you can do to improve your credit, read Fixing Your Credit FAQs.

Five Ways to Help Protect Your Identity

12/17/2025

The Alarming Facts About Identity Theft:

- A new victim likely emerges every 4.9 seconds.

- Last year, consumers filed a staggering 6.4 million reports of identity fraud.

- Victims suffered total losses exceeding $12.7 billion.

With sophisticated scammers leveraging new technology constantly, security experts urge the public to recognize the urgency of the situation. You must take immediate steps now to lock down your digital life and protect your sensitive information.

Take Action Now:

For comprehensive information on how to protect yourself, visit resources provided by the Federal Trade Commission (FTC) at consumer.ftc.gov.

If you believe you are a victim, report the incident and develop a recovery plan through the FTC’s dedicated portal: identitytheft.gov.

On Giving Tuesday: Donate to charities

(not scammers)

12/1/2025 Article by FTC.gov

Chances are, you’re probably already hearing from charities about Giving Tuesday. It’s a great time to support the work of charities around the country. Unfortunately, not everyone asking for money is a real charity. As the year comes to a close, you’ll likely get calls, texts, and emails asking for donations. Here’s how to make sure your money goes to real causes that matter to you instead of to a scammer.

- Confirm the charity is legit. Make sure you have the charity’s exact name and then do some research. Some dishonest telemarketers will use names that sound like well-known charities to confuse you, so here are some places to start:

- BBB Wise Giving Alliance and Charity Watch offer reports and ratings on how charities spend donations and run as organizations.

- Your state charity regulator can tell you if a charity is registered with them, which is a requirement in most states.

- Check that your donation is really going to the programs you want to help. Call the charity directly and ask how much of your donation will go to the programs you care about. You may also be able to get this information from the charity’s website.

- Consider how you pay. The safest way to donate is by credit card or check. If someone says the only way to pay is with cryptocurrency, a payment app, gift card, or by wiring money, it’s likely a scam, not a real charity.

- Double-check links. Pay attention to who’s asking and who’s getting the money —even if it’s something a friend posts on social media. If you’re sent to a crowdfunding page, money will go directly to the organizer…who might not be closely tied to the cause you want to support.

Spot a fake charity? Tell the FTC at ReportFraud.ftc.gov.

Be Wary of Fake Black Friday Websites

11/28/2025

While Black Friday brings great deals, it also sees a sharp rise in scams. From 2023 to 2024, fraudulent websites increased by 89%, and nearly 80% of shopping emails were identified as scams. Cybersecurity experts like Check Point, along with the FBI and Google, are now issuing warnings to help shoppers avoid fraud.

How to spot fake websites

Be cautious of sites impersonating popular brands like Stüssy, Longchamp, Wayfair, and IKEA.

Threat intelligence company EclecticIQ has found at least 8,000 fraudulent sites promoting fake deals, such as an $800 mattress for only $39. If a deal seems too good to be true, it probably is.

Check the URL carefully and look for a secure connection padlock and “https” at the beginning of the address. Missing these indicators is a major red flag.

Protecting yourself while shopping

Avoid clicking sponsored ads in search results, as these can redirect you to fake sites.

Type website addresses directly into your browser.

Research unfamiliar retailers through the Better Business Bureau.

Use a credit card for better fraud protection. Never pay with gift cards or cryptocurrency, which are nearly impossible to trace or refund.

Enable transaction alerts on your credit card to quickly catch fraudulent charges.

Watch out for delivery scams

Be wary of texts or emails claiming a package is delayed or requires a fee.

Instead of clicking links in the message, go directly to the company’s website or use a verified phone number to check your package status.

Supporting Veterans and Avoiding Scams

11/7/2025

Before You Donate: A Guide for Supporting First Responders, Military, Veterans, and Their Families

To ensure your donation has the most impact and to avoid scams, follow these important guidelines:

1. Research the Charity

Check reports and ratings from reputable organizations like give.org, charitywatch.org, guidestar.org, and charitynavigator.org.

Search the charity’s name online to see if others have reported it as a scam.

Be cautious of names that are similar to well-known charities.

2. Ensure Your Donation is Used Effectively

Ask the organization directly what percentage of your donation goes to the program you want to support.

3. Donate Securely

Avoid paying with gift cards or wire transfers, as these are often untraceable. Credit cards and checks are safer options.

When donating online, verify that the money is going to the intended organization.

For more information, visit the Federal Trade Commission’s website at ftc.gov/charity.

Get a Credit Freeze to Stop Identity Thieves

10/3/2025

by BCP Staff at FTC.gov

Did someone steal your identity? Or are you looking for ways to help protect yourself from identity theft? A great place to start is freezing your credit. Here’s what to know.

A credit freeze is something you can do anytime, for any reason. But it’s especially helpful if you’re dealing with identity theft or a lost wallet or data breach. While a freeze is in place, nobody can open a new credit account in your name.

A freeze

- is free to place or lift — and doesn’t affect your credit score

- is available to anyone, for any reason

- lasts until you lift it

To place a credit freeze, contact all three credit bureaus — Equifax, Experian, and TransUnion. When you need to lift the freeze — to do things like get a credit card or buy a car — you only need to contact the credit bureau a lender will use to check your credit. When you’re done, you can freeze it again. If you forget that you froze your credit and a lender runs a credit report, they will be notified that the credit is frozen. At that point, you can unfreeze your credit report for the lender to run it and then freeze it again afterward.

Along with a credit freeze, you can also get an initial fraud alert if you are — or suspect you may be — affected by identity theft. Initial fraud alerts (also free) make lenders verify your identity before they grant new credit in your name. There are also two other types of alerts — extended fraud alerts and active duty alerts — (both also free), and which you choose depends on your situation and needs. Read Credit Freeze or Fraud Alert: What’s Right for Your Credit Report? to learn more.

If your identity was stolen, also make sure you report it at IdentityTheft.gov, where you’ll get a free recovery plan with next steps.

Protect Yourself from Fake Loan Application Scams

9/9/2025

by BCP Staff at FTC.gov

A voicemail from an unknown caller reminding you about a $52,000 loan that you didn’t apply for can throw you off balance. Which explains why scammers send them — hoping you’ll respond first and think later. You might already know how to spot phone scams, but in case you need a refresher, here’s how to spot this one.

Some phone scams start with an unexpected call saying you’re “prequalified” for a loan. (You’re not.) The caller wants you to give them personal information like your Social Security or bank account numbers or birth date over the phone. They might say the application is almost finished and just needs a few more details from you. (Not true.) Or say things like “I hope you don’t miss out” or “no pressure.” (Those are pressure tactics.) In a voicemail, the caller might offer to take you off the call list…if you them call back. (Another pressure tactic.)

Scammers often make these seemingly urgent calls multiple times a day from different numbers to try and wear you down. But don’t respond — not even to “opt out.” If you’re getting calls like these on your cell phone:

- Never call back. If you do, it could lead to more scam calls.

- Don’t trust caller ID. Scammers use fake or “spoofed” names and numbers to make calls look local, like real companies, or like the government.

- Block the number. Check your phone’s settings, online app store, and your phone provider’s website to find out what call-blocking or call-labeling services are available to stop unwanted scam calls before they reach you. If any calls get through, they’ll show up as “spam” or “scam likely” on your phone screen.

Report unwanted calls to the FTC at ReportFraud.ftc.gov. Be sure to include the number on your caller ID and any number you’re told to call back.

Business and government impersonators go after older adults’ life savings

8/26/2025

by BCP Staff at FTC.gov

Scammers posing as government agencies or well-known businesses are increasingly going after retirees’ life savings. They weave a web of lies about some bogus crisis. Then they trick older adults into giving them tens or even hundreds of thousands of dollars.

The scams start with lies designed to create a sense of urgency and fear.

- Lie #1: Someone is using your accounts. Scammers pretend to be a bank employee with a warning about suspicious account activity. Or claim to be an Amazon rep following up on potentially fraudulent purchases.

- Lie #2: Your information is being used to commit crimes. Scammers might say they’re with the government and tell their target that their Social Security number is linked to serious crimes.

- Lie #3: There’s a security problem with your computer. This lie might start with a computer security alert that warns of a hacked computer with a phone number to call for help.

Once they’ve convinced their mark that this crisis is real, they make empty promises and offer fake “help.” They say the only way to get out of the situation is to follow their very specific instructions — which always involve moving money. They tell their target that doing so will protect the money in their accounts or clear their name. Some say they’re helping catch the “real” criminals.

A new FTC data spotlight report, False alarm, real scam: how scammers are stealing older adults’ life savings, shows that reports of losses to business and government imposters filed by older adults (60+) are soaring. Many reported losing tens and hundreds of thousands of dollars. In fact, reported losses of over $100,000 increased nearly sevenfold from 2020 to 2024.

How can you protect yourself from a business or government imposter scam?

- Never transfer or send money to anyone in response to an unexpected call or message. Even if they claim you’re moving your money to “protect it.”

- Talk about it with someone you trust. Especially if the stranger on the phone says it’s serious, involves a crime, or claims to be from the government.

- If you think the message could be real, verify the story. Contact the organization in question using a phone number, website, or email address you know is real. Don’t use the contact information in the unexpected message.

Government agencies will never threaten you, and they’ll never tell you to transfer your money to “protect it,” deposit cash into Bitcoin ATMs, or hand off stacks of cash or gold to a courier. That’s a scam. Report it to the FTC at ReportFraud.ftc.gov.

For more advice, check out How To Avoid Imposter Scams.

Scammy texts offering “refunds” for Amazon purchases

8/8/2025

Article by BCP Staff at FTC.gov

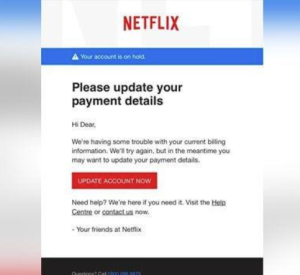

Scammers are pretending to be Amazon again. This time, they’re sending texts claiming there’s a problem with something you bought. They offer a refund if you click a link — but it’s a scam. Here’s how the scam works so you can avoid it.

You get an unexpected text that looks like it’s from Amazon. It claims the company did a “routine quality inspection” and an item you recently bought doesn’t meet Amazon’s standards or has been recalled. The text offers you a full refund and says you don’t need to return the item — as long as you click a link to request your money back. But there is no refund. Instead, it’s a phishing scam to steal your money or personal information.

To avoid a scam like this:

- Don’t click links in unexpected texts — and don’t respond to them. If you think the message could be legit, contact the company using a phone number, email, or website you know is real — not the info from the text.

- Check your Amazon account. If you’re worried, log in through the Amazon website or app — don’t use the link in the text — to see if there’s a problem with or recall on anything you’ve ordered.

- Send unwanted texts to 7726 (SPAM) or use your phone’s “report junk” option. Once you’ve reported it, delete the message.

Learn more about how to get fewer spam texts. And if you spot a scam, tell the FTC at ReportFraud.ftc.gov.

Help the people affected by flooding in Texas — not a scammer

7/18/2025

Article By BCP Staff at FTC.gov

In response to the devastating flash flooding in central Texas, many are looking for ways to get and give help. And scammers are looking to prey on people’s generosity. So how can you make sure your donations go to the people who need them and not to a scammer?

Donate to charities you know and trust with a proven track record of dealing with disasters.

Before you give, research the charity yourself — especially if the donation request comes on social media. Check out the charity on the Better Business Bureau’s Give.org, or Charity Watch. Find out exactly how much of your donation will go directly to the people the charity says it helps.

Don’t donate to anyone who insists you must pay by cash, gift card, wiring money, or cryptocurrency. That’s how scammers tell you to pay. If you decide to donate, paying by credit card gives you more protections.

Be cautious about giving to individuals on crowdfunding sites. Know that money raised in a crowdfunding campaign goes to the campaign organizer, not directly to the people or cause it’s set up to help. Review the platform’s policies — does it take measures to verify postings that ask for help after a disaster? And know that donating via crowdfunding is not tax deductible.

Confirm the number before you text to donate. If someone asks you to donate by text, call the number on the charity’s website to confirm you have the right number to donate by text.

To learn more about how to donate safely, go to ftc.gov/charity. For advice to help you prepare for, deal with, and recover from weather emergencies and the scams that follow, check out ftc.gov/weatheremergencies.

Comparing Credit, Charge, Secured Credit, Debit, or Prepaid Cards

7/11/2025

Payment cards like credit, charge, secured credit, debit, and prepaid cards offer various ways to make purchases without cash, each with distinct features, fees, and legal protections. Choosing the right card depends on your financial situation and spending habits.

Credit Cards

Credit cards allow you to borrow money to make purchases, which you then repay, typically with interest. The card agreement outlines interest rates (APR), credit limits, and fees. Paying bills on time helps build a good credit history, which influences eligibility for jobs, housing, insurance, and future borrowing costs.

Common fees include annual fees, setup fees, monthly maintenance fees, and charges for cash advances, balance transfers, and exceeding your credit limit. Late payments incur late fees and can significantly increase your APR. You can avoid interest on purchases by paying your full balance by the due date. Shopping around for the best APR is crucial to minimize costs.

Credit cards offer strong legal protections. Your maximum liability for unauthorized use before reporting a lost or stolen card is $50. They also provide dispute rights for various issues, such as incorrect charges, duplicate billing, undelivered items, or wrong/damaged goods, allowing you to potentially get your money back.

Charge Cards

Issued by financial companies, charge cards do not charge interest and typically have no pre-set spending limit. However, the full balance must be paid off with each statement, usually monthly.

Fees often include a high annual fee and late payment fees if the balance isn’t paid on time. Charge cards provide the same liability and dispute protections as credit cards, limiting unauthorized use liability to $50 and allowing for error disputes.

Secured Credit Cards

Secured credit cards require a deposit with the issuer, usually a percentage (even up to 100%) of your credit limit. This deposit acts as collateral, ensuring the issuer is paid if you default. The deposit is typically returned when you close the account and pay off your balance.

These cards are beneficial for building or improving credit history, as many issuers report your payment activity to credit bureaus. Consistent, on-time payments, staying within your credit limit, and meeting other requirements can help you qualify for an unsecured card in the future.

Secured cards often have higher APRs and annual fees than unsecured cards, along with potential activation or monthly maintenance fees. Despite this, they offer the same legal protections as other credit cards, including the $50 liability limit for unauthorized use and dispute rights for errors.

Debit Cards

Debit cards are linked to your checking account, allowing you to spend money you already possess. They generally don’t involve borrowing money or paying interest and do not help build credit history, as they draw directly from your funds rather than extending credit.

While there are no annual fees for debit cards, you might incur other checking account-related fees, such as maintenance fees or overdraft fees if you spend more than available. Overdraft protection for purchases may be offered, allowing you to overspend for a fee and interest, but requires prior opt-in. Without it, transactions exceeding your balance will be declined without an overdraft fee, though automatic payments may still incur fees.

Debit cards offer limited legal protections compared to credit cards. Your liability for lost or stolen cards depends on how quickly you report the issue, and delayed reporting can mean losing all your money. Dispute rights are also more restricted, though you may recover funds for unauthorized use or incorrect charges.

Prepaid Cards

Prepaid cards are loaded with money beforehand and allow you to spend up to that loaded amount. Many are reloadable, meaning you can add more funds. They are widely available, don’t require a bank account or good credit, and don’t involve interest.

Most prepaid cards have network logos (e.g., MasterCard, Visa), allowing them to be used wherever that logo is accepted. Cards without a network logo have limited usage. Generally, prepaid cards do not help build credit history as they are not reported to credit bureaus. Gift cards are distinct from prepaid cards, typically non-reloadable, and lack the same legal protections.

Fees for prepaid cards can include activation fees, usage fees (monthly or per-use), money-adding fees, ATM withdrawal fees, and inactivity fees. Issuers must disclose these fees before purchase and on their websites. Some prepaid cards offer the ability to spend more than the loaded amount, essentially acting as a credit line and potentially incurring interest and credit-related fees.

To gain legal protections, including limited liability for unauthorized use, it’s crucial to register your prepaid card, typically by following instructions on the card’s packaging.

Based on an article by the FTC: Comparing Credit, Charge, Secured Credit, Debit, or Prepaid Cards | Consumer Advice

National Scam Targeting Local Residents

6/13/2025

The “Publishers Clearing House” scam is a fraudulent scheme where scammers impersonate the legitimate sweepstakes company, claiming you’ve won a prize and that you need to pay taxes or fees to receive it. Never send money to claim a prize, sweepstakes winnings, or lottery winnings, as it’s a red flag of a scam.

Local residents are being targeted by a sophisticated check fraud scam.

Here’s how it works:

1. Fake Check Sent: Scammers send a fraudulent check to the victim, often with a convincing letter that includes the need to cover “taxes,” “fees,” or “processing charges” before receiving your full prize – which the check will cover…

2. Pressure to Deposit: The scammer instructs the victim to deposit the check into his/her bank account.

3. Urgent Wire Request: Before the fake check has a chance to officially clear (which can take several business days), the scammer calls the victim. They create a sense of urgency and instruct the winner/victim to wire funds for those pesky taxes immediately.

4. Victim Wires His/Her Own Money: Believing the fake check’s funds are available or soon will be, the victim wires money from his/her own personal funds to the scammer. For example, if a scammer sends a $1,000 check to taxes and fees, they might ask the victim to wire back the amount. If the person cannot send all of it back because of balance limitations – they will accept whatever “can” be sent. After all – the big prize is coming right after the victim/winner gets the complete prize (which is never coming!).

5. Check Bounces, Victim Loses Money: Days later, the original fake check bounces (identified as fraudulent) and the funds are removed from the victim’s account. However, the money the victim wired to the scammer is gone and cannot be returned. The victim is personally out the money (e.g., $2,300) with no way to recover it. Note: gift cards may also be requested as payment…

Key points about the scam:

- Fake Letters/Emails: Scammers send letters or emails claiming you’ve won a Publishers Clearing House or other “known” company prize.

- Request for Payment: They ask you to send money upfront for “taxes,” “fees,” or “processing charges” before you receive your “full” prize.

- Fake Checks: Some scams include fake checks that are certain to be returned unpaid, leaving you responsible for the funds.

- High-Pressure Tactics: Scammers often use urgency or pressure tactics to encourage you to act quickly.

- Unsolicited Contact: PCH only contacts individuals who have entered their sweepstakes.

- Strange Payment Methods: Scammers often request payment through methods like gift cards, wire transfers, or cashier’s checks, which are difficult to trace and recover.

Real vs. Fake:

- Legitimate PCH winners are not asked to pay upfront.

- PCH uses its own channels for contacting winners.

- Taxes on lottery winnings are handled by the IRS and are not paid upfront.

What to do if you receive a suspicious communication:

- Don’t Respond: Ignore the letter, email, or phone call.

- Don’t Send Money: Never send money or give out personal information.

- Report It: Report the scam to the Federal Trade Commission (Federal Trade Commission website) or your local police department.

The two big rules to follow:

1. If it sounds too good to be true, it probably is.

2. If you’re really not sure, come see us. We see these things regularly and know how to spot a scam!

Pass It On (Let’s Talk Scams)

5/16/2025

Last year in New Hampshire, 8,872 residents filed fraud reports. Not all of those reports resulted in a loss. However, the losses reported in New Hampshire total a staggering $14,650,766.

This video from the Federal Trade Commission shows how easy it is to start a conversation about scams and how to protect yourself from them. Learn more about passing on information that could help someone you know at ftc.gov/passiton.

NH Data: https://public.tableau.com/app/profile/federal.trade.commission/viz/FraudReports/StateSubcategories (choose your state and year)

Americans Share Best Financial Advice They Ever Received —It’s Eye-Opening

5/9/2025

Summary of article from Newsweek by Soo Kim

Separating needs from wants and saving money as early as possible are among the top money tips that Americans have received, a new poll has shown.

The poll conducted for Newsweek by Talker Research between April 11 and 17 asked 1,000 Americans to share the most-impactful financial advice they have ever been given. Here are the results:

- Start Saving Early: Emphasizes the power of compounding over time for retirement and financial well-being. Even small amounts saved early can significantly grow.

- Save Regularly: Highlights the importance of consistent saving habits, whether a fixed amount per paycheck or a percentage of income, tailored to individual goals.

- Stay Out of Debt: Advises avoiding debt, except possibly for a mortgage, as it hinders saving and the benefits of compounding. Living below one’s means and paying with cash is recommended.

- Know Your Needs Vs. Wants: Stresses the importance of distinguishing between essential expenses and discretionary spending to make informed financial decisions. A “day per dollar” rule can help with impulse purchases.

- Have More Than One Source of Income: Suggests diversifying income streams for greater financial security. Living off one income and saving/investing the other is one strategy.

- Have Your Own Bank Account When Married: Recommends maintaining individual bank accounts within a marriage for financial independence and as a safeguard during difficult times.

- Focus on What You Can Control: Advises concentrating on actionable steps like cutting expenses, increasing emergency funds, and avoiding panic during financial challenges. Small, consistent efforts are key.

- Remember That Money Goes Quickly: A sobering reminder that regardless of income, money tends to be spent, emphasizing the need for mindful spending and financial awareness.

Americans Share Best Financial Advice They Ever Received—It’s Eye-Opening – Newsweek

Smart In-Person Payment Habits

4/18/2025

Carrying at least two payment methods (like a credit card and debit card, or credit card and cash) is a smart move for several reasons:

Backup: If one card is declined, you have another way to pay.

Flexibility: Some situations (small purchases, tips) are better suited for cash.

Security: Reduces risk if one card is lost or compromised.

Convenience: Choose the best method for the situation (e.g., credit card online, cash for vendors).

Having multiple payment options offers both convenience and crucial financial protection. It’s a simple way to be prepared for various spending scenarios.

Traveling? Consider carrying 2 cards and cash. And always notify your card company before traveling overseas. For your NHFCU cards call us at 603-224-7731

Protect yourself (and your money)

from scammers this Financial Literacy Month

4/4/2025

By: BCP Staff at consumer.ftc.gov

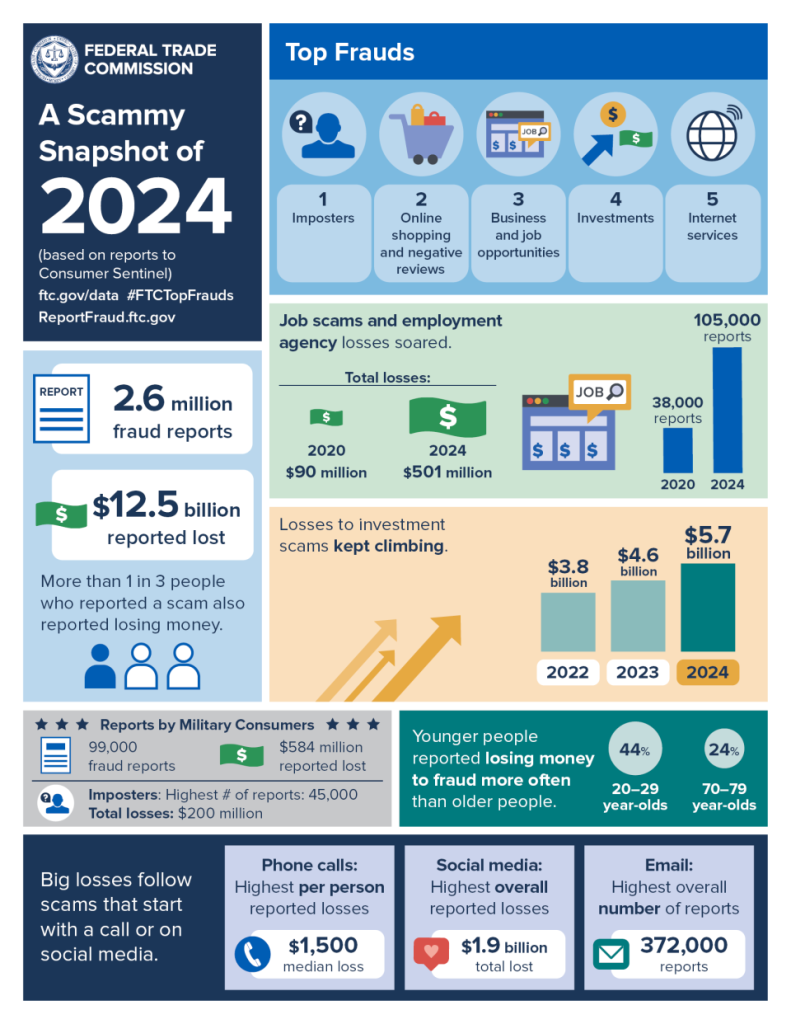

All year long, scammers are looking for ways to steal your hard-earned money. FTC data shows people reported losing $12.5 billion to scams in 2024, which is up $2.5 billion from 2023. April is Financial Literacy Month: a great time to check out the free resources at consumer.gov to help manage your money while protecting it from scammers.

Looking to make a budget that helps you save money, buy a car, rent an apartment or house, or deal with debt? Consumer.gov has the info you need to spot, avoid, and report scams as you make your plans.

At consumer.gov, you’ll get the basics on managing your money and advice on:

• How to protect your money and information from scammers

• What to do if you think you sent money to a scammer or gave a scammer your personal information

• How to protect yourself from identity theft

You’ll also find videos and free, one-page handouts to share with family, friends, and other groups you might be a part of — like your neighborhood association, church group, or club meeting.

And if you spot a scam, tell the FTC at ReportFraud.ftc.gov.

Top scams of 2024

3/12/2025

Article by BCP at FTC.gov

Did you or someone you know report a scam to the FTC in 2024? Thank you! Those reports help the FTC bring enforcement cases and educate people about scams. Let’s jump into the top 2024 scams.

The headline is this: even though the number of fraud reports is roughly the same as last year, more people lost a lot more money to fraud. One in three people who reported fraud said they lost money (up from one in four last year), adding up to $12.5 billion (up $2.5 billion from 2023). People lost over $3 billion to scams that started online, compared to approximately $1.9 billion lost to more “traditional” contact methods like calls, texts, or emails. However, people lost more money per person (a median of $1,500) when they interacted with scammers on the phone. And, once again, imposter scams topped the list of scams reported.

Here are some other things to know:

The biggest scam losses happened by bank transfer or payment. Among all payment methods, people reported losing more money through a bank transfer or payment ($2 billion), followed by cryptocurrency at $1.4 billion.

Investment scams led to big losses. A majority (79%) of people who reported an investment-related scam lost money, with a median loss of over $9,000. The $5.7 billion losses in this category are up about $1 billion from last year.

People reported losing money more often when contacted through social media. Most people (70%) reported a loss when contacted on a social media platform — and lost more money overall ($1.9 billion).

Job scams and fake employment agency losses jumped — a lot. Between 2020-2024, reports nearly tripled and losses grew from $90 million to $501 million.

Younger people lost money more often. People aged 20-29 reported losing money more often than people 70+. But when older adults’ lost money, they lost far more than any other age group.

The biggest takeaway? Your reports make a difference. If you see a fraud or scam, the FTC wants to hear about it: go to ReportFraud.ftc.gov.

Check out the graphic for the top scams of 2024 below. Read the 2024 Data Book for more details and to learn what happened in your state.

Protecting Your VA Benefits and Avoiding Scams

2/21/2025

Event Description

The Federal Trade Commission (FTC) and the U.S. Department of Veterans Affairs’ Veterans Benefits Administration are partnering during National Consumer Protection Week to present a free webinar. Join the discussion to learn about ways to protect your veterans pension and disability benefits from scammers and what to know if you’re a veteran (or family member) applying for VA benefits.

To join the webinar on March 5th, 2025, at 2:00 pm ET:

URL: https://ftc.zoomgov.com/j/1605654091?pwd=KWMlMqmiRUs8w4vjeQEKagRhzWq1Ck.1

Webinar ID: 160 565 4091

Passcode: 887316

For more details visit: https://www.ftc.gov/news-events/events/2025/03/protecting-your-va-benefits-avoiding-scams-english

Back to Basics: How to Protect Yourself

02/14/2024

By MyCreditUnion.gov

Despite how common cyber threats are, there are steps you can take to protect yourself. Make sure you have up to date anti-virus software installed on all of your devices and use strong passwords and multi-factor authentication. Use credit cards with chips when practical, as they tend to offer more protection than debit cards. Keep track of your purchases, monitor your statements and alert you card issuer if you notice suspicious activity. You can also freeze or lock your credit with the credit bureaus to keep access to that information very limited.

Freezing? Maybe freeze your credit, too

02/07/2024

By Kira Krown, Consumer Education Specialist, FTC

New year, new chance to think about ways to protect yourself from identity theft. What’s one way? Freeze your credit.

You don’t have to wait for your Social Security number or other information to be exposed in a data breach — or misused by an identity thief — to benefit from a credit freeze.

Here’s how a credit freeze can protect you: it stops lenders from getting into your credit report. Because lenders usually won’t give you credit if they can’t review your credit report, a freeze can help stop would-be identity thieves from opening new accounts in your name.

Some more things to know:

- Anyone can place a credit freeze, they’re free to place and lift, and they don’t affect your credit score.

- To place a credit freeze, contact all three credit bureaus: Equifax, Experian, and TransUnion.

- Credit freezes last until you lift them. So if someone needs to check your credit — like if you’re applying for a new credit card or a car loan — you’ll need to contact all three bureaus again. (Or if you know which bureau a lender will use, you can lift for only that one. For free.)

You may have also heard about fraud alerts, which are another useful tool against identity theft. Learn about the difference between credit freezes and fraud alerts here.

Finally, if you think someone’s stolen your identity, go to IdentityTheft.gov to report what happened and get an individualized recovery plan with next steps.

Mobile Payment Apps: How To Avoid a Scam When You Use One

01/24/2024

Based on an article by the FTC

Mobile payment apps like Venmo, Cash App, and PayPal offer a convenient way to send and receive money via smartphones. After setting up an account and linking a payment method, users can transfer funds, which are stored in the app until transferred to a bank account.

However, scammers may try to exploit these apps by pretending to be someone in need or claiming you’ve won a prize, urging you to send money. To avoid falling for scams, avoid sending money to claim prizes, never share your account details, protect your account with multi-factor authentication, and verify unexpected money requests with the sender.

What To Do if You Sent Money to a Scammer

If you find unauthorized payments or think you paid a scammer, here’s how to report it to the mobile payment app.

Cash App. Cash App recommends chatting through their app for the fastest service. To do so, open the app, go to your profile, and choose Support. You can also get help through cash.app/help or by calling 1 (800) 969-1940.

Venmo. Venmo recommends chatting through their app for the fastest service. To do so, open the app, go to your profile, and choose Get Help. You can also email Venmo through their contact form or call them at 1 (855) 812-4430.

PayPal. Report it online through PayPal’s Resolution Center or call PayPal at 1 (888) 221-1161.

Report It to the FTC

If you paid a scammer with a mobile payment app, report it to the Federal Trade Commission at ReportFraud.ftc.gov. When you report a scam, you help the FTC and other law enforcement agencies stop scams.

Email or social media hacked? Here’s what to do

01/06/2024

By Alvaro Puig, Consumer Education Specialist, FTC.gov

Hackers target your email and social media accounts to steal your personal information. Like your username and password, bank or credit card account numbers, or Social Security number. If they get it, they use it to commit identity theft, spread malware, or scam other people. So, what are signs that someone hacked your account, and how can you recover a stolen account?

Here are some things that might tip you off to a problem:

You get a notification that your email address or phone number changed. Or that your password was reset. But you didn’t make those changes.

You get a message that someone tried to log in, or did log in, and it wasn’t you.

You can’t log in to your account.

If you can’t log in to your account, the FTC offers links to recover your account via this article https://consumer.ftc.gov/consumer-alerts/2024/10/email-or-social-media-hacked-heres-what-do

If you get a notification about activity you don’t recognize, and you can log in, here’s what to do:

Change your account password. Create a unique and strong password that is hard to guess. Aim for 12 to 15 characters. Or use a passphrase — a series of words separated by spaces. Then sign out of that account on all devices. That way anyone who’s logged in to your account on another device will get kicked out.

Secure your account. If the account offers two-factor authentication (2FA), turn it on to add an extra layer of security. That way, a hacker with your password can’t log in to your account without a second authentication factor. Like a verification code you get by text or email, or from an authenticator app.

Update your account recovery information. Account recovery information helps you get back into your account if you’re locked out, forgot your password, or if someone else is using it. Check your account recovery information and make sure the email address and phone number listed are correct.

Check for signs that someone had access to your account. Check if there are auto-forwarding rules in your email account that you didn’t set up. Hackers might create these rules to forward your emails to another address. Check your social media for messages the hacker posted or sent, or for new friends you don’t recognize.

If you believe someone stole your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Scammers are delivering phishing messages this holiday season

12/10/2024

Article by Ari Lazarus, Consumer Education Specialist, FTC.gov

During the holiday season, you might expect to get more deliveries. Some might even be surprise gifts. Scammers are counting on that when they send fake delivery notifications to you by email and text, hoping you’ll click. Here’s how to spot these scams.

You get an email or text and it says you missed the delivery. Or it might say your item can’t be delivered because you need to update your street address or zip code. Sometimes these scammers create a sense of urgency by saying if you don’t respond right away, they’ll return your package to the sender. The scammers say both of these issues can easily be fixed: just click on a link.

Why do they want you to click that link? It’s a phishing scam. If you click, scammers could get information like your usernames and passwords for your online banking, email, or social media accounts. Scammers could then use those to steal your identity and open new accounts in your name. They might also install malware on your computer.

To avoid fake shipping notification scams:

Don’t click on links in messages about an unexpected delivery. If you get a message about an unexpected package delivery that tells you to click on a link for some reason, don’t click.

Contact the shipping company directly to get more information. If you think the message might be legitimate, contact the shipping company using a phone number or website you know is real. Don’t use the information in the message.

Check your order status. If you think the message could be about something you recently ordered, go to the site where you bought the item and look up the shipping and delivery status there.

No matter the time of year, it always pays to protect your personal information. Check out these resources to help you weed out spam text messages, phishing emails, and unwanted calls. ftc.gov/onlinesecurity

Protecting Your Child’s Identity & Credit Score

Between the day your child is issued their social security number and the day they turn 18 years old, it is your job as a parent to protect them from identity theft.

What Is Child Identity Theft?

Child identity theft happens when someone takes a child’s sensitive personal information and uses it to get services or benefits or to commit fraud. They might use your child’s Social Security number, name and address, or date of birth. They could use the stolen information to:

- apply for government benefits, like health care coverage or nutrition assistance

- open a bank or credit card account

- apply for a loan

- sign up for a utility service, like water or electricity

- rent a place to live

Take Action

In addition to protecting your child’s social security number, consider “freezing” your child’s credit.

If your child is under 16, you can request a free credit freeze, also known as a security freeze, to make it harder for someone to open new accounts in your child’s name. The freeze stays in place until you tell the credit bureaus to remove it. (Minors who are 16 or 17 can request and remove a security freeze themselves.)

To activate a credit freeze, contact each of the three credit bureaus. Find their contact information at IdentityTheft.gov.

For additional information on how to protect your child from identity theft visit: How To Protect Your Child From Identity Theft | Consumer Advice

In Honor of Veterans Day, share how you spot and avoid scams

By Samuel Levine, Director, Bureau of Consumer Protection, FTC.gov

Every November, people put out social media posts to honor family and friends who’ve served in the military. But did you know that service members and veterans reported losing more than $350 million to fraud last year?

Chances are, fraud has happened to someone you know. This year, make sure your Veterans Day tribute includes ways to help veterans, service members, and military families spot scammers.

When you talk about scams you’re seeing, you help veterans spot and avoid them too. So, tell your neighbor if you’ve heard about scammers who call claiming to help veterans file for benefits — but they’re really trying to steal their personal information or military benefits. Let grandpa know about a scam call you got that sounded real and said there’s something supposedly wrong, like unauthorized charges, with your bank account. You knew it was a scam because the caller told you to withdraw cash and deposit it into a specific Bitcoin ATM to protect it (big red flag!), so help your family members spot that scam. Offer to help your newly enlisted cousin sign up for free active-duty credit monitoring to restrict access to their credit report and protect against identity theft.

Once the conversation gets going, let them know you’re there to help. Share advice and resources to help them spot scams — and to know what to do if they were scammed. Here are three resources to get you started:

- MilitaryConsumer.gov/blog gives you the latest on scams. Subscribe to get updates sent straight to your inbox.

- VSAFE.gov combines federal resources to help veterans learn about many different fraud types and how to handle them — from car-buying to housing to military and veteran benefits.

- The National Veterans Financial Resource Center (FINVET) knows that financial well-being is linked to better mental health. Check out their tools to protect your money.

If you or someone you care about spots a scam, tell the FTC at ReportFraud.ftc.gov.

Avoid Scammers During Marketplace Open Enrollment

By Kira Krown, Consumer Education Specialist, FTC.gov

Looking to get or switch your Marketplace health insurance during open enrollment (November 1, 2024 – January 15, 2025)? Don’t click on ads that say they offer free things like phones or cash cards for gas, groceries, or bills to those who enroll in a health insurance plan. They’re probably scams.

The same goes for ads showing a famous person supposedly endorsing an insurance plan or services: That “person” might be a computer-made fake.

Instead, use the official Health Insurance Marketplace to find plans you qualify for, get help signing up, or enroll in the plan you choose directly.

To stay clear of scammy ads and get real help during open enrollment:

- Go to HealthCare.gov or call the Marketplace Call Center (1-800-318-2596) to compare and sign up for Marketplace plans.

- Find Local Help through Marketplace’s online directory. You can set up a time to talk in person, over the phone, or by email with Navigators who give free, unbiased help. You can also find and speak with licensed and registered agents and brokers.

And when you’re looking for health insurance, protect your money and information:

- Don’t pay anyone who claims they’re from the Marketplace or government and demands cash, cryptocurrency, or your credit or debit card numbers so you can get or keep health coverage.

- Don’t reply if someone you don’t know contacts you about health insurance and asks for your Social Security number or other personal, financial, or health information.

Report scammy healthcare ads by calling the Marketplace Call Center at 1-800-318-2596. Then tell the FTC: ReportFraud.ftc.gov.

Stay Alert for “Wrong Number” Text Scams

October 25, 2024

Have you received a text from an unfamiliar number claiming to know you? These messages often reference urgent meetings or casual hangouts. A simple “Sorry, wrong number,” which confirms they have reached a valid number, can be exactly what scammers are looking for.

Once they have your attention, scammers might try to engage you in friendly conversation, sometimes for weeks or even months, before attempting to pull you into any number of scams.

Best Ways to Protect Yourself:

- Ignore messages from unknown numbers: Responding confirms your number is active, which can lead to more scams.

- Block suspicious numbers right away: This helps prevent further contact from scammers.

- Never clicking on links from unknown numbers: Links may lead to malicious websites that can infect your device with malware.

- Keep personal information private: Never share personal or banking details.

If you’re an NHFCU member and suspect your personal or financial information has been compromised, please contact us right away.

Safely Donating to Hurricane Recovery Efforts

October 15, 2024

Recovering from the devastating flooding and destruction of a hurricane takes time and money. To make sure your hard earned money is donated to people in need and not scammers, review the information below.

Donating Safely and Avoiding Scams

When you decide to support a cause you care about, you want your donation to count. Doing some research and planning your giving can help ensure your donations get where they’ll do good. Here are tips to help you plan your donation– and avoid scams.

Do some research online

- Looking for a charity to support? Search for a cause you care about – like “hurricane relief” or “homeless kids” – and phrases like “best charity” or “highly rated charity.”

- When you consider giving to a specific charity, search its name plus “complaint,” “review,” “rating,” or “scam.”

- Use these organizations to help you research charities.

- Donating by cryptocurrency? Watch for scammers who want to take your donation. Learn more at ftc.gov/cryptocurrency.

Be careful how you pay

- If someone wants donations in cash, by gift card, or by wiring money, don’t do it. That’s how scammers ask you to pay.

- To be safer, pay by credit card or check.

- It’s a good practice to keep a record of all donations. And review your statements closely to make sure you’re only charged the amount you agreed to donate – and that you’re not signed up to make a recurring donation.

- Before clicking on a link to donate online, make sure you know who is receiving your donation. Read Donating Through Crowdfunding, Social Media, and Fundraising Platforms for more information.

Keep scammers’ tricks in mind

- Don’t let anyone rush you into making a donation. That’s something scammers do.

- Some scammers try to trick you into paying them by thanking you for a donation that you never made.

- Scammers can change caller ID to make a call look like it’s from a local area code.

- Some scammers use names that sound a lot like the names of real charities. This is one reason it pays to do some research before giving.

- Scammers make lots of vague and sentimental claims but give no specifics about how your donation will be used.

- Bogus organizations may claim that your donation is tax-deductible when it is not.

- Guaranteeing sweepstakes winnings in exchange for a donation is not only a scam, it’s illegal.

If you see any red flags, or if you’re not sure about how a charity will use your donation, consider giving to a different charity. There are many worthy organizations who will use your donation wisely. Report scams to ReportFraud.ftc.gov. Find your state charity regulator at nasconet.org and report to them, too. Share any information you have – like the name of the organization or fundraiser, phone number, and what the fundraiser said.

Organizations that can help you research charities

These organizations offer reports and ratings about how charitable organizations spend donations and how they conduct business:

- BBB Wise Giving Alliance

- Charity Navigator

- CharityWatch

- Candid

The IRS’s Tax Exempt Organization Search tells you if your donation would be tax deductible.

You can find your state charity regulator at nasconet.org. Most states require the charity or its fundraiser to register to ask for donations.

SOURCE: https://consumer.ftc.gov/features/donating-safely-and-avoiding-scams

PREVENT Account FRAUD and Identity THEFT

October 10, 2024

PROTECT YOUR PERSONAL INFORMATION

Protecting your personal and account information is our top priority. At NHFCU, your information is safe and secure. With account fraud and identity theft on the rise, it is important for you to help protect yourself. Here are a few tips:

Education

Skilled identity thieves use a variety of methods to gain access to your personal information. The best way to protect your identity is to educate yourself and be aware of common scams. Visit nhfcu.org/FraudSecurity on our website for information on current scams, and links to additional resources.

Credit Report

Combat fraudulent activity by monitoring your credit report. If accounts are opened in your name, they will appear on your credit report. Consumers can obtain a free credit report annually from all three credit bureaus at www.annualcreditreport.com. This is the only official free credit report website.

Online and Mobile Banking

Prior to entering your account information, verify that you are using our website: ww.nhfcu.org and not a spoofed site (fake email or website address that looks legitimate). Always be sure to log out of online or mobile banking before closing the window or app. Never store your personal or account information in plain text on your computer or mobile device. Consider using a secure wallet to securely store your account information and passwords.

Personal Information

NHFCU will never contact you by phone, email or text asking you to provide account numbers, passwords, social security numbers or other personal information. Do not respond and notify us immediately if you receive such a request. And if you receive an email or text asking you to log into your account, do not click on any links or respond. Instead, call us directly. This is true for most companies that you do business with. Thieves can impersonate real companies through email, text and phone in order to steal your information. Call the company directly to verify the legitimacy of the request.

Suspicious Activity

If you think you have been the victim of fraud, if you doubt the authenticity of a solicitation, notice or email regarding your NHFCU account or you suspect your account has been compromised, contact us at (603) 224-7731, or 1 (800) 639-4039.

Hang Up on Unwanted Calls About Loans

September 24, 2024

Based on an Article by Bridget Small, Consumer Education Specialist

People are reporting getting multiple calls, sometimes from different numbers, about their supposed “loan application.” They haven’t applied for a loan. What should you do if this happens to you?

- Don’t press a number to “unsubscribe.” That only lets the dishonest company know your number is good. Instead, just hang up.

- Use call blocking to stop calls before they reach you. Learn how at How to Block Unwanted Calls. For your mobile phone, find a list of call-blocking apps at ctia.org.

- Don’t give information to businesses you don’t know, even if they seem to know you. That could be a set up to get your personal information.

- Register your cell and home phone for free at the National Do Not Call Registry. Registration never expires and is designed to stop unwanted sales calls from companies that follow the law. Being on the registry doesn’t block calls and won’t stop calls from scammers — However, eliminating legitimate sales calls makes it easier to spot the scammers.

If you’ve gotten calls like these, report unwanted calls at DoNotCall.gov.

Hang Up on Unwanted Calls About Loans

September 24, 2024

Based on an Article by Bridget Small, Consumer Education Specialist

People are reporting getting multiple calls, sometimes from different numbers, about their supposed “loan application.” They haven’t applied for a loan. What should you do if this happens to you?

- Don’t press a number to “unsubscribe.” That only lets the dishonest company know your number is good. Instead, just hang up.

- Use call blocking to stop calls before they reach you. Learn how at How to Block Unwanted Calls. For your mobile phone, find a list of call-blocking apps at ctia.org.

- Don’t give information to businesses you don’t know, even if they seem to know you. That could be a set up to get your personal information.

- Register your cell and home phone for free at the National Do Not Call Registry. Registration never expires and is designed to stop unwanted sales calls from companies that follow the law. Being on the registry doesn’t block calls and won’t stop calls from scammers — However, eliminating legitimate sales calls makes it easier to spot the scammers.

If you’ve gotten calls like these, report unwanted calls at DoNotCall.gov.

IMPORTANT Fraud Spoofing Reminder

August 22, 2024

An important reminder: Be cautious about calls seemingly coming from NHFCU requesting your full account or debit card numbers, etc.

Fraudsters are known to “spoof” information to appear legit on caller IDs. NHFCU reps and our fraud monitoring services will not ask you for complete account numbers, PINs, etc. If you question the validity of a fraud monitoring call or text message, please contact us directly.

Please share this information with family and friends.

How to avoid getting burned by solar or clean energy scams

August 15, 2024

Article written by Larissa Bungo, Senior Attorney, FTC.gov

When temperatures rise, utility costs do, too. While reputable companies can help you save money with clean or solar energy improvements, scammers offer more than they can deliver. The scams vary, but here’s the gist: someone claiming to be with the government or your utility company promises big savings on your utility bills from solar energy or other home improvements designed to increase energy efficiency. If you agree to the scammer’s offer, it could cost you tens of thousands of dollars.

These scams start with an unexpected phone call, message on social, or even an in-person visit. The so-called official offers you an “energy audit” to reduce your utility costs. Or they might try to sign you up for a “free” program to make your home more energy efficient with solar energy. While they might say they’re from your utility company or the government, they’re not. And while they promise free or low-cost solar panels, or offer you huge rebates, tax credits, or utility incentives to pay for those solar panels, those are lies. Some so-called officials even say your utility company already signed you up for the program, so now you need to pay. That is, of course, also a scam.

To protect yourself from clean energy scams:

- Know that “free” or “no cost” solar panel offers are scams. The federal government does not install solar systems in homes for free. If you’re considering whether solar energy is right for you, check out the Department of Energy’s guide for homeowners and learn more. Or check out the Department of Treasury’s guidance on clean energy.

- Take your time. Anyone who pressures you into a contract or demands up-front or immediate payment is a scammer. Legitimate businesses and government agencies don’t pressure you to act immediately and won’t tell you to pay with cash, gift card, wire transfer, payment app, or cryptocurrency. But imposters will. Learn more at ftc.gov/imposters.

- Protect your personal information. Don’t respond to unexpected requests online or on social media for your name, address, or other personal information to “see if you qualify.” At best, this is someone generating leads to sell, not actual solar businesses. At worst, they’re scammers trying to steal your identity.

If you spot a scam, tell the Federal Trade Commission at ReportFraud.ftc.gov.

Scammers Impersonate Airline Customer Service Representatives

August 7, 2024

Article written by Alvaro Puig, Consumer Education Specialist, FTC.gov

Most people can probably agree that there are few things more frustrating than airline delays or cancellations that leave you stranded at the airport. Whether the issues are the result of an unprecedented event like the Crowdstrike glitch that grounded thousands of flights worldwide, or more common disturbances like weather delays, desperate travelers often turn to social media for help from the airlines.

Scammers crawl social media looking for posts from upset travelers. They reach out to them through fake social media accounts and pretend to be an airline customer service representative who’s there to help. The scammers ask passengers for a slew of information, like their booking confirmation number, phone number, or bank account. Or they send passengers to a spoofed site that harvests their personal information and use it to steal the passenger’s identity or rack up charges on their accounts.

If you’re dealing with travel troubles, here’s how to avoid getting re-routed to an airline impersonator:

- Log in to your airline account and contact customer service through the airline’s official app, website, chat, or phone number.

- If you’re at the airport, speak to a customer service representative in person.

- If you reach out through social media, find the airline’s official social media page on their website. Look for a verification symbol or badge. And never give out personal information on social media.

If someone stole your personal information, go to IdentityTheft.gov to report it and get recovery steps. And report imposters to the FTC at ReportFraud.ftc.gov.

Visit FlightRights.gov to learn about the airline passenger protections you are entitled to, or to file a complaint with DOT if an airline is not treating you fairly.

Scammers target young adults on social media with fake check scam

July 24, 2024

Based on an article written by Larissa Bungo, Senior Attorney, FTC.gov

Young adults have reported encountering a fraudulent scheme that commences with a direct message on social media from an individual who expresses admiration for your photo and offers to compensate you with a substantial sum in exchange for its usage. Following this, they will dispatch a check to you. Subsequently, they will instruct you to deposit the check, withdraw a portion of the funds to send to the artist for procurement of supplies, and retain the remaining amount. There may be assurances of reimbursing any funds sent back; however, this never materializes as it is a deceitful scheme.

Despite the check appearing authentic and the funds reflecting in your bank account initially, the check is counterfeit. Once the bank detects this, you will have lost the money sent to the scammer and be liable for any withdrawn funds.

How can you identify this scam? The key takeaway is this: if an unfamiliar individual sends you a check and requests you to remit funds back to them or to a third party, it is a scam. It is advisable to exclusively deposit checks received from acquaintances whom you know and trust.

Learn more about how to spot fake check scams.

If you spot a scam, report it at ReportFraud.ftc.gov.

And if you think you’ve paid a scammer, here’s what to do.

Scammers target young adults on social media with fake check scam | Consumer Advice (ftc.gov)

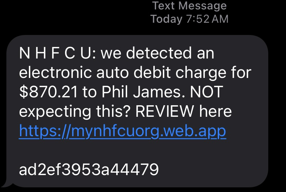

Got a call about fraud activity on your bank account? It could be a scammer

July 11, 2024

Based on an article by Terri Miller, Consumer Education Specialist, FTC

Beware of scammers contacting you via phone, email or text with a warning involving fraudulent activity on your financial accounts. It’s a scam. Here are 7 things to keep in mind if you think you are dealing with a scammer:

- Stop and take the time to verify the legitimacy of any communication by contacting your official bank, broker, or investment advisor using the contact information on your statements.

- Do not transfer funds with anyone claiming to protect your money – unless YOU initiate the transaction by contacting your financial institution using their PUBLISHED NUMBERS.

- Do not share verification codes with anyone claiming to protect your money.

- Contact your financial institution to report any suspicious incidents.

- Your funds are secure where they are, regardless of persuasive tactics used by fraudsters. Never move money to “protect it” – unless you know your information has been compromised!

- Exercise caution when receiving unsolicited calls, texts, or messages asking for personal financial information or money transfers. Never share verification codes.

- Bank accounts offer fewer protections than credit cards, so be cautious about transferring funds out of your account.

- Promptly inform your financial institution and report suspicious communications to the Federal Trade Commission.

Share this advice to help protect others from falling victim to scams.

Military Consumer Month 2024

July 3, 2024

Based on an article by Samuel Levine, Director, Bureau of Consumer Protection, FTC

July is Military Consumer Month, so we’re deploying advice you can use. Imposter scams can target individuals at any point in their military journey, whether they are new recruits or seasoned veterans. These scams involve perpetrators posing as trusted entities such as financial institutions, government agencies, family members in trouble, reputable companies, or IT professionals. To safeguard yourself and your loved ones from falling victim to such deceitful schemes, it is crucial to stay informed and alert. By seeking guidance and resources from the Federal Trade Commission (FTC), you can equip yourself with the knowledge and tools necessary to recognize and combat these fraudulent activities effectively.

Scammers are constantly evolving their tactics to deceive individuals into giving away their money or sensitive personal information. To protect yourself, it is crucial to stay informed about the latest scamming techniques. Always remain vigilant and remember the BLUF (bottom line up front) advice: If your bank or credit union unexpectedly contacts you regarding suspicious account activity, verify the legitimacy of the call as it could be a scam. Be cautious of job recruiters on online platforms offering high-paying work-from-home opportunities; research the job offer thoroughly before proceeding, as it could be a fraudulent posting. Similarly, exercise caution when encountering attractive rental deals on social media; ensure the legitimacy of the listing before making any payments, as scammers often create fake rental postings for properties that are not available. By staying informed and conducting due diligence, you can stay one step ahead of scammers and safeguard your finances and personal information. Learn more at ftc.gov/imposters.

To keep up with what’s happening related to scams, sign up for email updates at MilitaryConsumer.gov.

Job Scams That Start on Social Media

June 28, 2024

By Colleen Tressler, Division of Consumer and Business Education, FTC

Here’s a new scam spotted on social media: appointment setting jobs. They claim you can work from home and make big money. But just what does an appointment setter do? And how can you tell the difference between a legit job offer and a scam?

An appointment setter is someone who schedules calls for a company’s sales staff and potential clients to help them close deals. You’re typically paid an hourly rate, but might earn bonuses based on the number of appointments you successfully set. If you need training, the employer should offer it at no cost to you.

Now that you know the basics, here are some ways to tell the difference between an appointment setter job scam and a legitimate position. Scammy ads tend to promise a very high income. The truth is that real appointment setting is a normal job with a modest income. Scammy job offers claim you have to pay thousands of dollars upfront for training. The truth is honest employers will never ask you to pay to get a job. Scammers say they’ll guarantee you a job once you pay for training. The truth is no one can guarantee you a job. Scammers may also look more like a business opportunity than a paid position, promising you potential clients, or suggesting you recruit new people to their “job” training programs, instead of setting appointments.

Before you accept a job or business opportunity offer:

- Take your time and talk to someone you trust. Scammers will try to pressure you to get involved or risk losing out.

- Do some research. Search online for the name of the company and words like “review,” “scam,” or “complaint.” Check with your state attorney general for complaints. No complaints? It doesn’t guarantee that a company is honest, but complaints can tip you off to possible problems.

- Read success stories and testimonials with skepticism. They might not be true or typical. Glowing stories of success could be fake or misleading, and positive online reviews may have come from made-up profiles.

If you see a job or business opportunity scam, or lose money to one, report it to the FTC at ReportFraud.ftc.gov.

No one is using your Social Security number to commit crimes. It’s a scam.

May 14, 2024

If you ever receive a call from someone claiming to be from the Social Security Administration, it’s essential to be cautious. One common scam involves a caller who claims that your name and Social Security number are linked to serious crimes or there is an arrest warrant out for you and that the courts want to seize your bank and retirement accounts. Do not provide any personal information or agree to purchase anything, such as gold, as this is a tactic used by scammers to steal your money.

If you receive such a call, it’s best to hang up immediately and report the incident to the Federal Trade Commission. It’s crucial to remember that the Social Security Administration would never call you to threaten or intimidate you. The Social Security Administration will always communicate with you through the mail, and they will never ask you to disclose your Social Security number over the phone. Be vigilant and protect yourself from these types of scams.

It can be a scary experience when someone calls you out of the blue and demands that you go to the bank immediately. It’s natural to feel nervous and overwhelmed in such a situation. However, it’s important to keep your wits about you and not let the caller push you into making a hasty decision. If you’re unsure about the legitimacy of the call, take a moment to do some research before following their instructions. Anyone who asks you to withdraw cash or buy gold is likely trying to scam you. Don’t hesitate to report them to the FTC at ReportFraud.ftc.gov. Stay vigilant and protect yourself from these types of scams.

If you ever receive a call from someone claiming that someone is coming to your house to pick up valuable items, such as cash or gold, it’s crucial that you call the police immediately. This type of elaborate impersonation scheme is designed to rip you off and can lead to serious consequences. To learn more about this and other common imposter scams, be sure to check out How to Avoid Imposter Scams | Consumer Advice (ftc.gov). By staying informed and aware, you can help protect yourself from falling victim to these types of fraudulent schemes.

Protect Your Accounts

April 30, 2024

- Safeguard your cards, PINs, receipts, and deposit slips. It is essential to handle these items with care and shred all paperwork with personal information. Thieves still go though trash.

- When you go out shopping, carry only the cards you’ll need, leave the rest safe at home.

- Avoid carrying your pin with you. Never write your PIN on the card itself, or in a place someone could see.

- Make sure your PIN isn’t something that someone could easily guess like a birthday or easy to figure out by watching you type it in such as 1234 or 5555.

- Always make sure to cover the keypad with your other hand while typing in your PIN.

- If you think your PIN has been compromised you can change your PIN on our mobile App under “Cards” or call 1-800-992-3808 (for future reference, store this number in your phone).

Protect Yourself from Phishing Scams

March 28, 2024

In today’s digital age, it is crucial to be aware of the threat of phishing. Phishing occurs when malicious individuals use deceptive links via emails or texts or call to trick you into revealing sensitive personal information such as account details or passwords. These scammers can then exploit this information to commit identity theft or financial fraud. By clicking on malicious links, you could inadvertently expose your computer to ransomware and other harmful programs, compromising your data security. Stay vigilant and safeguard your personal information by being cautious of unsolicited communications and verifying the authenticity of requests before sharing any sensitive data.

Stay informed and vigilant against phishing scams by recognizing common tactics used in deceptive emails and text messages. Scammers often impersonate trusted companies or institutions to lure unsuspecting individuals into clicking on malicious links or opening harmful attachments. By being cautious of unexpected messages and verifying the sender’s legitimacy, you can protect yourself from falling victim to fraudulent schemes. Avoid clicking on links in unsolicited emails, even if you are familiar with the vendor.

Here are examples of how scammers trick you; they:

Here are examples of how scammers trick you; they:

Say they have noticed suspicious activity or log-in attempts — Phishing!

Say there’s a problem with your account or your payment information — Phishing!

Say some personal or financial information needs to be confirmed — Phishing!

Send you an invoice you don’t recognize — Fake!

Ask you to click on a link to make a payment — The link has Malware!

Say you’re eligible to register for a government refund — Scam!

Offer a coupon for free stuff — Fake! Phishing!

Protect yourself from Phishing emails:

1. Install security software on your devices and keep it up-to-date

2. Use multi-factor authentication on all your accounts

3. Back up your data to protect it.

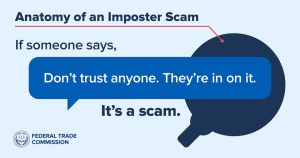

Sure Ways to Spot a Scammer

March 20, 2024

Things only scammers will say:

“Act now!” That’s a scam. Scammers use pressure, so you don’t have time to think. But pressuring you to act now is always a sign of a scam. It’s also a reason to stop.

“Only say what I tell you to say.” That’s a scam. The minute someone tells you to lie to anyone — including bank tellers or investment brokers — stop. It’s a scam.

“Don’t trust anyone. They’re in on it.” That’s a scam. Scammers want to cut you off from anyone who might slow you down.

“Do [this] or you’ll be arrested.” That’s a scam. Any threat like this is a lie. Nobody needs money or information to keep you out of jail, keep you from being deported, or avoid bigger fines. They’re all scams.

“Don’t hang up.” That’s a scam. If someone wants to keep you on the phone while you go withdraw or transfer money, buy gift cards, or anything else they’re asking you to do: that’s a scammer. DO hang up.