Courtesy Pay Overdraft Protection

NHFCU Introducing Additional Overdraft Protection

WHAT COURTESY PAY OVERDRAFT PROTECTION MEANS FOR YOU

Manage your money with confidence…no more wondering if your payments will be paid or returned for non-sufficient funds. Beginning January 1, 2024, eligible checking accounts* will AUTOMATICALLY receive up to $500 in Courtesy Pay Overdraft Protection. You also have protection when we transfer from your savings or overdraft loan.

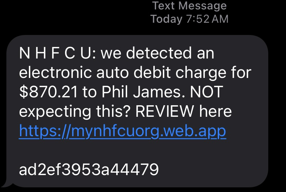

WHAT TO EXPECT

- If you overdraw your account by check, a bill payer, or an Automated Clearing House (ACH) transaction AND your account is eligible for overdraft protection, your payment will be made as long as your total overdrafts do not exceed $500.

- You will incur a $30 fee from us when this occurs, but you will avoid the cost and embarrassment of having your payment returned to the merchant.

- Each time Courtesy Pay is initiated, we will send you a notice. This is an additional benefit with your checking account from NHFCU.

- If you have overdraft transfers from your savings or overdraft loan, these transfer options will be initiated before Courtesy Pay.

- If you wish to OPT OUT of this benefit, please contact us directly at (603) 224-7731.

Important: Courtesy Pay is only available for checks or automatic payments made directly from your checking account with us if your account is eligible*. If you would like to activate additional protection for ATM or debit card transactions, you will need to OPT IN to this service.

Call us at (603) 224-7731 ext. 514 for these instructions during regular business hours.

*We do not promise to pay every overdraft. There are restrictions and eligibility requirements for this protection along with a $30 fee for each instance. See the complete information below.

* NHFCU COURTESY PAY OVERDRAFT PROTECTION ELIGIBILITY REQUIREMENTS

• Primary account holder must be age 18 or older.

• Member in good standing with NHFCU.

• Checking account established for a minimum of 30 days.

• Checking account has received a minimum of $500 in deposits in 30 days.

• This service may be revoked at any time by NHFCU.

• Members may opt out of receiving this service at any time by notifying NHFCU.