Financial Literacy Tips – Avoiding Credit Card Debt

A little financial wellness never hurt anyone… Understanding core financial principles can significantly impact our lives and our budgets. Richard Barrington, a financial analyst for Credit Sesame, shares five must-know financial tips everyone should learn. This week we will focus on credit card debt.

Avoid credit card debt

According to Barrington, credit card debt is notably the most hazardous type of debt one can incur. This is primarily because credit cards are always readily available, making it far too easy to accumulate debt.

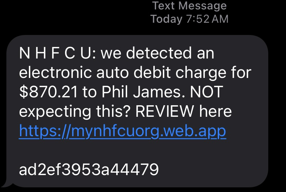

The high interest rates associated with credit cards (average of 24.74% APR as of August 2024) exacerbate the issue. Compare that to a 12.8% interest rate for personal loans, a 6.73% rate for car loans, or a 6.59% for a mortgage, and you’re treading dangerous waters. Note: NHFCU’s Visa credit card is at 12.9% annual percentage rate.

Furthermore, the lack of a fixed repayment period means that credit card debt can continue to accrue interest indefinitely, deepening the financial hole.

Would you buy an item that had a ticket price of $200 but when you got the register it costs $221.59? If you put that purchase on a credit card, that is exactly what you are doing.

MIT Sloan completed a study where they found that credit cards serve to ‘step on the gas’ by putting costs out-of-mind regardless of the price of the product. More specifically, the study revealed that credit cards drive greater purchasing by sensitizing reward networks in the brain, involving the same dopaminergic reward center (the striatum) that is exploited by addictive drugs…”

With credit cards being readily available, lack of a fixed repayment period, incredibly high interest rates, and the psychological aspects of credit card usage, there is the high possibility of accruing interest indefinitely, deepening the financial hole.

Pay more than the minimum on credit cards

As Barrington points out, one strategic approach to managing credit card debt is to always pay more than the minimum payment required. Credit card companies benefit when consumers extend their repayment period, as this leads to more accumulated interest. By paying more than the minimum, you can significantly reduce the lifespan of your debt and save on interest.

As with any debt, paying extra towards the principle each month can reduce the lifespan of the loan and save you money on interest. This is even more pronounced when talking about credit cards. Credit cards have some of the highest rates averaging around 25% and some as high as 33%. By paying more than the minimum payment, you will not only pay the credit card down fast you will pay a lot less in interest.

Example. A credit card with a $3,000 balance at rate of 25% and minimum payment of 80.00 will take 74 months to pay off and cost you an additional $2,896 in interest – totaling $5,896.

By paying an additional $100 each month it will take you 21 months to pay off and cost you an additional $723 in interest – totaling $3,723, that’s a savings of over $1,100.

Credit cards can be a good thing when used properly. If you are diligent about paying off 100% of the balance each month, they can cost you nothing. Using them in this way can be a positive financial decision as they may improve your credit score and can provide you with rewards points or travel miles with each purchase.

At NHFCU, we emphasize and provide financial education because we recognize the importance of sharing our knowledge with our community. In addition to our free videos and classes, we offer one on one coaching for those who want additional personalize assistance. Coaching is where we share our knowledge, answer your questions, and give you the tools to be successful in your financial journey.

Stay tuned for our next article on credit scores.

You can reach our Centers for Finance & Education via email centerFE@nhfcu.org or phone at 603-224-7731 ex 330.